Garda and nurse can’t afford 3-bed Dublin semi

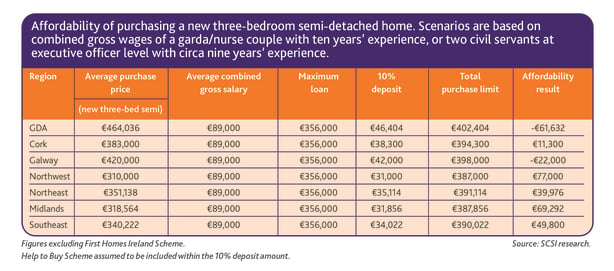

A nurse and garda with combined gross earnings of €89,000 cannot afford to buy a 3-bed semi detached home in the Greater Dublin Area, according to the Society of Chartered Surveyors Ireland.

The case studies, which are based on a couple employed as public servants such as garda and a nurse with ten years’ experience, show that a new home remains out of reach by tens of thousands of euro.

The affordability gap for these first time buyers in Dublin, Wicklow, Meath, and Kildare is just under €62,000. The gap in Galway its €22,000.

The case studies indicate that the Northwest, Midlands, and Southeast are the most affordable regions for first time buyers.

John O’Sullivan, Chair of the SCSI’s Practice and Policy Committee said, “Right now, new housing is most viable in the Greater Dublin Area, and this is where its most unaffordable. In very many cases the areas where new home building is least viable are the more affordable areas, such as the Midlands and Northwest.

“To restore balance to the property market we need to ensure there is an adequate delivery of new housing through other avenues such as AHBs, via the Land Development Agency and through direct public housing delivery .”

A new survey by the Society of Chartered Surveyors Ireland indicates residential property prices will continue to stabilise in the medium term with estate agents forecasting an increase of just 1% in 2024.

Almost two out of three respondents (63%) believe property prices have either peaked and should start to decline or are close to peaking and will level off soon.

The report found the main factors influencing expectations of house price movements are the supply of housing, interest rates and changes in the economy.

Mr O’Sullivan said it looks now as if prices are set to consolidate for the medium term.

“SCSI agents believe we will see modest growth in values in what will most likely be another challenging year for the property market. Three out of four agents or 76% of respondents are reporting a lack of supply to meet demand, that’s up 10% on last year. So, while price inflation has been dampened following the dramatic rise in interest rates, they have also been underpinned by the lack of supply.”

He said prices are levelling off below current inflation rates which is a welcome development for potential buyers as their purchasing power will increase as affordability improves.

While the current supply of new homes is undoubtedly insufficient, SCSI agents say initiatives aimed at increasing supply are kicking in and that the situation will improve in the coming years.

“Interestingly after supply, interest rates and the state of the economy, the fourth factor which members say will influence price movements is a potential change in Government and or housing policy,” Mr O’Sullivan said.

“We know there is going to be a new Government in the next 14 months or so and some members are clearly picking up on the need to build on progress to date and to avoid knee jerk policy shifts which could introduce uncertainty into the market.”

Buy-to-lets

The SCSI’s Annual Residential Review and Outlook report also found that one in three of properties coming on the market are buy-to-lets.

On average 36% of residential sale instructions to agents in Q4 were landlords selling their investment property. While this is down 4% from last year, Mr O’Sullivan said it shows investors and landlords are continuing to exit the market in very significant numbers.

“While new taxation measures announced by the Government in Budget 2024 aimed at encouraging landlords and investors to remain in the market are only being implemented now, SCSI agents are saying the main reason rental units are continuing to come on the market in such numbers is that rent legislation is too complex and restrictive.

“The other reasons given are a potential change in Government / housing policy, net rental returns being too low, coming out of negative equity and pressure from lending institutions to liquidate assets.”

The figures show that landlords are continuing to exit the market in substantial numbers and with mortgage approvals for residential investment lettings down 20% year on year, the SCSI say it’s clear those leaving are not being replaced in the same numbers by new investors.

“This in turn is going to affect the number and choice of rental units available on the market and contribute to higher rents,” he said.

Sales not proceeding

There has been a steady increase in the proportion of SCSI agents reporting that sales are not proceeding. In the survey 27% of agents said there had been an increase in the numbers of sales not proceeding while 63% of agents reported that the level of sales not proceeding remained the same as the preceding six months, when the issue first came to prominence.

An analysis shows an increasing prevalence of members reporting significant frustration regarding delays within the probate process and in contacting the probate office. Agents highlighted challenges regarding an inefficient and lengthy conveyancing process and how this is impacting on sales as well as other issues such as planning irregularities, non-compliance with building regulations and boundary challenges.

BER

It is now just over a decade since Building Energy Ratings were first introduced and SCSI members believe there is a widening price gap between energy-efficient homes – rated B or higher – and their less efficient counterparts – rated C or lower.

This is due to the time and costs required to pay for refurbishments to the latter, despite the availability of grants.

In the survey 69% of agents said they believed BER ratings are an important or very important influence on the level of offer made on a property.

Mr O’Sullivan said that while they started out initially as a mere footnote on property brochures, they were now front and centre in buyers’ thoughts.