How overpaying your mortgage could save you thousands

Paying off your mortgage early could save you thousands and help you to become debt free at a younger age.

Irish households are sitting on combined savings of €153 billion – most of which is earning little to no interest.

So, if your mortgage rate is higher than the rate on your savings account, it could be worth considering overpaying on your mortgage.

What are the first steps?

Before you consider making overpayments on your mortgage, you should check you are on the best interest rate available.

With many lenders now reducing rates, Margaret Barrett, Managing Director of mortgage advisory firm Mortgage Navigators said it is a good time to review your switching options.

“By switching to a lower interest rate, and keeping your monthly mortgage repayments the same, you reduce the term and save significantly on the amount of interest you pay,” she added.

Once you are confident you have the best rate possible, you should then review the overpayment options offered by your lender.

How much can I overpay?

If you you’re on a variable rate you can overpay as much as you like without any penalties.

But if you’re on a fixed rate, you have signed up to pay a set amount each month – and so the interest rate and repayments are fixed.

Martina Hennessy, CEO of mortgage advisory company Doddl.ie said most, but not all lenders offer some flexibility when it comes to fixed rates.

“This can range from 10% of the monthly repayment allowable as overpayment, right up to 20% of the capital balance allowable annually as overpayment,” she explained.

If your lender does not allow for flexibility to overpay, Ms Hennessy said you may need to break out of the fixed rate contract.

But in doing so, you could face a penalty.

“The penalty would be based on the incremental cost to the bank for you exiting the fixed contract early.

“In general if funding costs drop from when you lock in, you would be exposed to a penalty, if funding costs rise you would not,” she explained.

Looking at securing a split rate – part fixed and part variable – could also be an option, Ms Hennessy said.

“You can then overpay on the variable element as you choose without risk of penalty,” she explained.

How will the overpayment be applied?

There are a number of ways in which a mortgage overpayment can be applied.

It can be used to reduce your mortgage repayments, meaning that the mortgage balance decreases and if you keep to the same term, your monthly repayments will decrease.

But Ms Hennessy of Doddl.ie said the alternative and most beneficial use of overpayment is to clear down the capital balance but keep your repayments the same.

This would result in a reduced mortgage term and lower cost of credit.

“When you are making the overpayment you need to discuss how you wish the overpayment to be applied, to reduce the monthly repayment or keep the repayment the same and reduce the mortgage term,” she said.

How much could I save?

Ms Hennessy shared the following example, based on a mortgage amount of €300,000, an interest rate 3.6% and a mortgage term of 30 years.

“Repayment on these terms would be €1,364 per month, with an overall cost of credit of €191,017 over the 30 years,” she explained.

“If you were to overpay this mortgage by €100 per month then you will save €24,815 on interest over the mortgage term plus clear your mortgage three years and five months earlier than the original 30 year term.”

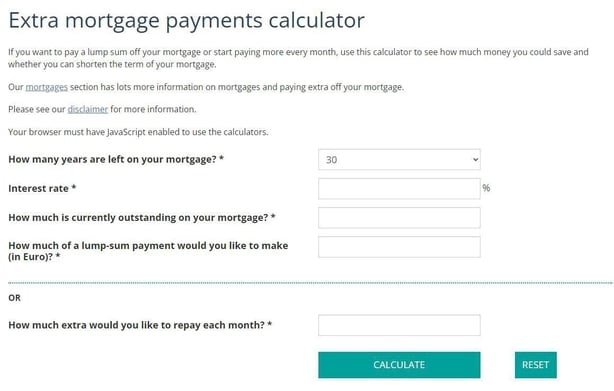

The Competition and Consumer Protection Commission (CCPC) has a calculator on its website which allows you to work out how much money you could save and whether you can shorten the term of your mortgage.

Is it better to make lump sum payments?

Whether you make monthly or lump sum payments will very much depend on your own financial situation.

Ms Barrett of Mortgage Navigators said the lump sum will make a larger impact and reduce the term immediately.

But if a lump sum is not available, she said a smaller 10% monthly overpayment will also have a significant impact.

“This is also a facility that can be started and stopped at the discretion of the client, without any penalty,” she said.

Ms Hennessy of Doddl.ie said overpayment whenever you have the means to do so is always worthwhile, but she said the earlier you can repay the mortgage the better.

“When you take out a mortgage initially your repayment is made up of interest and capital,” she explained.

“While the mortgage balance is high at the start of the mortgage, the proportion of interest in the repayment outweighs the capital amount you are clearing off the outstanding balance.

“That’s why at the end of the year when you get your mortgage statement you may be surprised to see that very little has been cleared off the outstanding mortgage.”

What are the main benefits of overpaying on your mortgage?

Interest saving

One of the main benefits of making extra payments on your mortgage is reducing the amount of interest you’ll pay over the term.

“By paying down the principal faster, you decrease the total amount of interest that accrues over time, potentially saving you thousands of euros,” Ms Barrett said.

Early loan payoff

Overpaying on your mortgage can help you pay off your loan ahead of schedule.

Ms Hennessy of Doddl said for those who take out terms of up to 35 years or expiry at age 70 years, it is always wise to be conscious of how you can reduce the term downwards.

Improved cash flow

Paying off your mortgage early can free up your monthly budget by eliminating one of your largest expenses.

“This extra cash flow can be redirected toward other financial goals such as retirement savings, investments, or paying off other debts,” Ms Barrett pointed out.

What are the main risks of overpaying on your mortgage?

Missed investment opportunities

By using your extra cash to pay down the mortgage early, you may have missed out on potential investment opportunities that could have provided higher returns.

Ms Barrett of Mortgage Navigators said this is dependent on the interest rate on the mortgage versus the rate of return on the investment.

Reducing cash reserves

Allocating all your disposable cash towards the mortgage repayments means you are reducing your cash reserves for emergencies or unexpected expenses.

“Taking financial advice is crucial before you make any decision on using lump sums,” Ms Barrett said.

Impact on retirement planning

Using funds to pay off your mortgage may impact your retirement savings, or your contribution towards your pension contributions.

“It’s essential to strike a balance,” Ms Barrett said.

Would I be better off investing or topping up a pension or savings?

When it comes to investing, it very much depends on the return that you can get on your investment and your appetite for risk.

“Investments have a potential for upside but also a risk of loss of funds,” said Ms Hennessy of Doddl.ie.

“Longer term investments tend to lead to greater return but also can mean your funds are less liquid,” she explained.

According to Ms Hennessy, there is no one rule for all, and this decision will depend on a number of factors.

“It is always advisable to have a savings nest egg to allow for loss of earnings or emergencies but once you are satisfied that you have savings in place and you are making a pension contribution, it is wise to consider mortgage overpayment,” she said.

“There is also the emotional element to clearing down your mortgage, to have that security of owning your family home.

“This is certainly something many people plan for and work towards and part of this can be overpaying your mortgage to accelerate repayment,” she added.

On the other hand, contributing towards a pension from your income is extremely tax efficient.

But Ms Barrett of Mortgage Navigators said if your mortgage term is to age 70 and you want to retire at 60, some action is needed to ensure you are debt free at your desired retirement age.