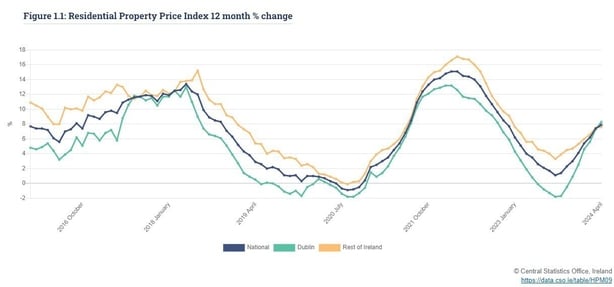

Property prices growth hits near 18-month high of 7.9%

New figures from the Central Statistics Office show that residential property prices grew at the fastest annual pace in almost a year and a half, increasing by 7.9% compared to growth of 7.4% a month earlier.

This marked the eighth consecutive month of annual house price growth as housing supply is still not growing fast enough to cool demand which has also proved relatively immune to higher mortgage interest rates.

The CSO said that Dublin property prices saw an annual increase of 8.3%, while property prices outside Dublin were 7.6% higher in April when compared with the same time last year.

Today’s CSO figures show that in the 12 months to April, house prices in Dublin rose by 8.8% while apartment prices increased by 6.2%.

The highest house price growth in Dublin was in South Dublin at 10.5% while Fingal saw a rise of 7.1%.

Outside of Dublin, house prices were up by 7.3% and apartment prices increased by 10.3%.

The region outside of Dublin that saw the largest rise in house prices was the Mid-West (Clare, Limerick, and Tipperary) at 9.7%, while at the other end of the scale, the Border (Cavan, Donegal, Leitrim, Monaghan, and Sligo) saw a 5.4% rise.

The CSO said that households paid a median or mid-point price of €335,000 for a residential property in the 12 months to April.

The lowest median price paid for a home was €169,000 in Longford, while the highest was €624,999 in Dún Laoghaire-Rathdown.

Meanwhile, the most expensive Eircode area over the 12 months to April was A94 “Blackrock” with a median price of €720,000, while F45 “Castlerea” had the least expensive price of €133,000.

The CSO said today that a total of 3,572 home purchases at market prices were filed with the Revenue Commissioners, an increase of 9.5% when compared with the 3,262 purchases the same month last year.

Today’s figures reveal that property prices nationally have increased by 144.3% from their trough in early 2013.

Dublin residential property prices have risen by 143.3% from their February 2012 low, while residential property prices in the rest of the country are 153.7% higher than at the trough in May 2013.

Davy Stockbrokers today predicted that property prices will grow by 7.5% this year due to a limited increase in transactions.

Trevor Grant, chairperson of Irish Mortgage Advisors, said today’s CSO figures show that house price growth continues to power ahead in Ireland.

Mr Grant said that while housing supply is increasing – which means more opportunities for buyers – so too are prices.

He said this means that many homebuyers, particularly first-time buyers who make up the largest cohort of buyers, will be disappointed that house price inflation is not softening.

“A real issue is that despite record commencement numbers only in recent months, approximately only one-third of these new properties will be made available to private purchasers,” Mr Grant said.

“This lack of supply combined with the continued high level of demand and potentially falling interest rates is likely to add to house price inflation. Furthermore, the shortage of new homes available to private buyers means many first-time buyers are bidding against trader-uppers/movers, which in turn is driving up second-hand prices,” he added.

He noted that a report published by the ESRI last month found that the average loan-to-income ratio in the Irish mortgage market is now back to multiples only previously seen at the peak of the Celtic Tiger boom.

He added that the recent ECB rate cut could encourage more house buyers into the market, which in turn could drive further house price inflation.