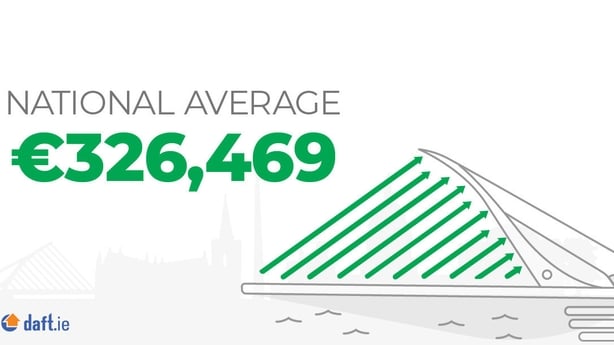

Prices sought for homes rose 1.8% in first quarter

Asking prices sought for homes across the country climbed another 1.8% between January and the end of March compared to the previous three months, as supply remains constrained.

The latest Daft.ie House Price Report shows that nationally, the advertised price for a house or apartment was €326,469.

That was an increase of 5.8% on the same period at the start of 2023 and represents a more than doubling of the inflation rate in a year.

The report shows prices are rising in year-on-year terms in 51 of the 54 markets covered, falling only in Dublin 2, Dublin 4 and Dublin 6.

Ronan Lyons, economist at Trinity College Dublin and the author of the report said the main factors driving the trends seen over the last few years and resuming this year are an overall shortage, together with the impact of the Central Bank rules.

The report shows that the number of homes advertised to buy on Daft on March 1st stood at below 10,500.

That’s down 24% year-on-year and a new all-time low for the series which extends back to January 2007, with the number of homes to buy currently just 40% of the 2019 average.

All major regions were affected by the apparent fall off in availability.

However, it should also be noted that properties are advertised on platforms other that Daft and some are sold in off-market transactions.

“The new low in homes available to buy is driven by the second-hand segment and highlights the very tight conditions in the second-hand market across the country since covid19,” said Mr Lyons.

“The number of homes being built has risen steadily. But interest rate increases have affected the recovery of the second-hand market.”

“As interest rates peak and then fall, and in particular as sitting homeowners roll of fixed rate mortgages, there should be an improvement in second-hand supply.”

“Nonetheless, availability is well below half the levels seen pre-Covid19, meaning it may take years for second-hand supply to recover to normal levels.”

In Dublin prices were 3.2% higher in the first quarter than a year previously.

Across the rest of Leinster, the increase was higher at 5%.

However, in the regional cities of Waterford and Limerick the rate of increase was over 10%, while in Cork City prices rose by 7.3% and in Galway city the increase was 9.4%.

Outside of the cities, prices in Munster were 10.9% higher and in Connacht-Ulster they were up 6.7%.

“It is a feature – not quite a bug but certainly not an intended result – of the Central Bank’s mortgage rules that they shift housing demand out of more expensive areas like Dublin and, effectively, down the motorway network,” Mr Lyons said.

“On the one hand, this seems a sensible outcome and directly follows from incomes varying geographically a lot less than the price of housing. But commuting costs, which are outside the mortgage rules, are equally capable of stretching a household’s finances.”

The research also shows that across the country, the typical transaction price in the fourth quarter of 2023 was 4% above the listed price.

A year ago, the gap nationally had been 1.3%, while two years ago, in the first three months of 2022, the typical transaction price was 3.7% above the listed price.